1 of 15

11 months ago

Fri Sep 29, 2023 5:51 pm

Beefy

Seasoned Rebel

Nov 2021 I accidentally “didn’t know better” opened a CFA account.

The account only reports to Experian and only Experian has the CFA reason statement.

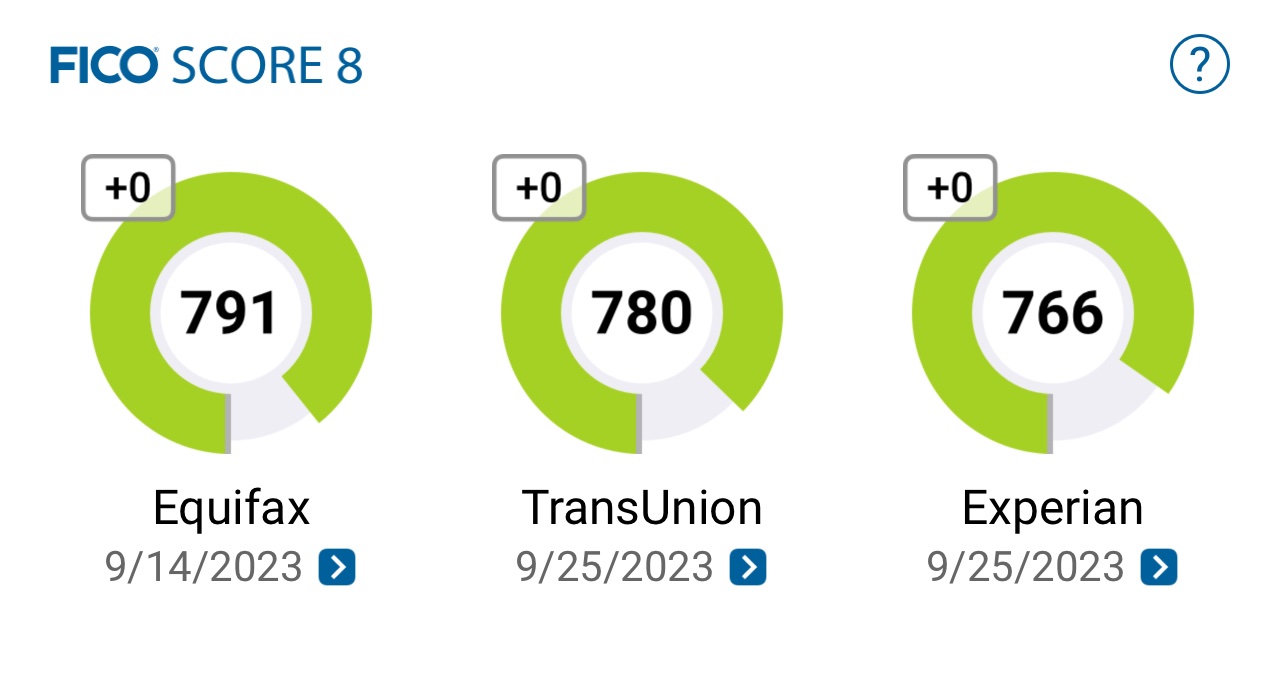

Looking at my scores and reports I estimate a single CFA account is roughly a 19-20 point loss.

All three CRA currently have the same balance reported and age of account metrics.

Scores are as follows:

EQ 1 inquiry

TU 3

Ex 2

EQ vs TU is 11 points this can be chalked up as the effect 2 inquiries.

Ex vs TU has a 14 point spread with one less HP.

If you count the inquiry as a 5ish point loss/gain that means 14+5-6 means the CFA is suppressing my ex score 19-20 points.

This would be on a young/thick/new revolver scorecard unless a CFA forces scorecard reassignment. At which point my musings are meaningless.

Does anyone have any relevant data points to confirm this?

EQ 1 inquiry

TU 3

Ex 2

EQ vs TU is 11 points this can be chalked up as the effect 2 inquiries.

Ex vs TU has a 14 point spread with one less HP.

If you count the inquiry as a 5ish point loss/gain that means 14+5-6 means the CFA is suppressing my ex score 19-20 points.

This would be on a young/thick/new revolver scorecard unless a CFA forces scorecard reassignment. At which point my musings are meaningless.

Does anyone have any relevant data points to confirm this?

Click images to enlarge them.

-

Score data

EQ8-791; TU8-780 EX8-766

EQ9-816; TU9-776; EX9-776

EQ5-729; TI4- 740; EX2-723 - Classic 8 Scorecard CLEAN/THICK/YOUNG/NEW-REVOLVER

- Mortgage Scorecard CLEAN/THICK/YOUNG/NEW-ACCOUNT

- AoOA 2y5m

- AoORA 2y5m

- Date of Last Inquiry and/or New Account Opening May 28th, 2024

- Garden Goal 12